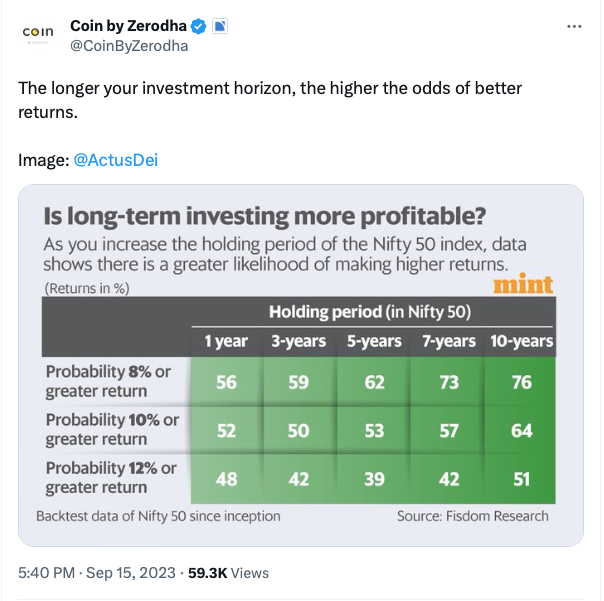

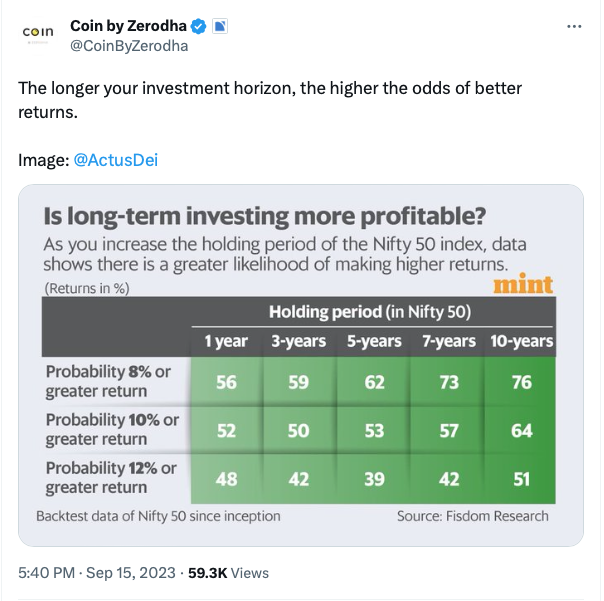

A recent tweet citing Mint wringer talks well-nigh how the probability of higher returns increases with increasing investment horizon.

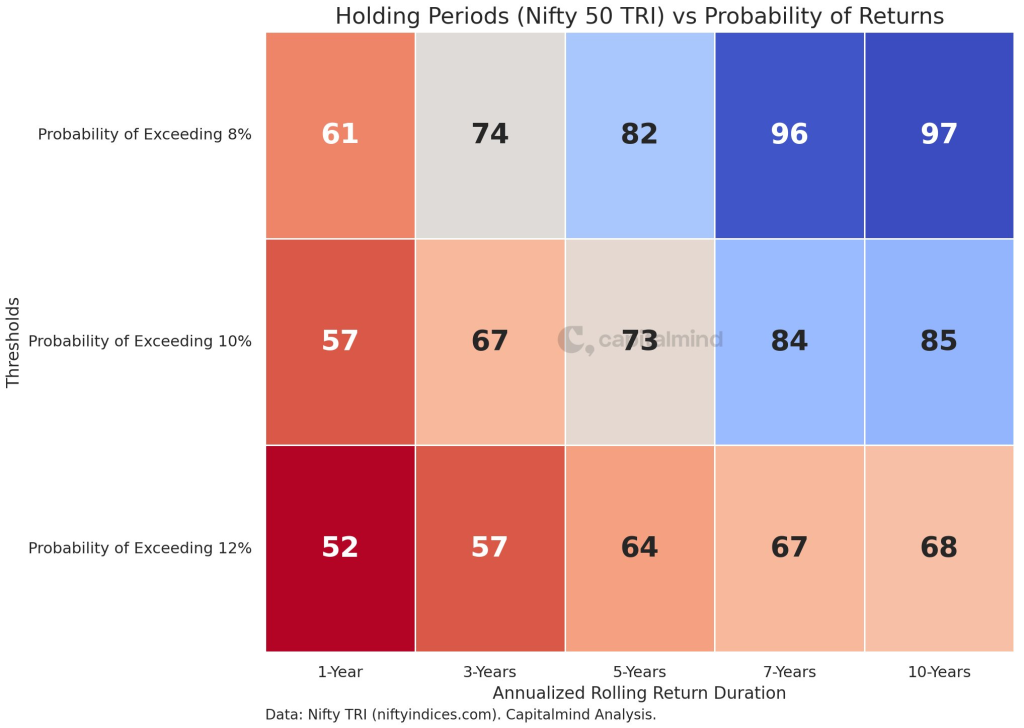

The numbers looked a bit off, so I recreated the wringer using the Nifty 50 Total Returns Index.

The numbers in each of the cells are higher than what is shown in the wringer cited in the Mint article. For instance, the probability of returns exceeding 8% over a 10-year holding period goes up from 76% to 97%, a sizable difference. Similarly, the probability of exceeding 12% over 10 years is only 51% (a forge toss) in the Mint piece but is 68% on the understructure of our analysis, a significant increase.

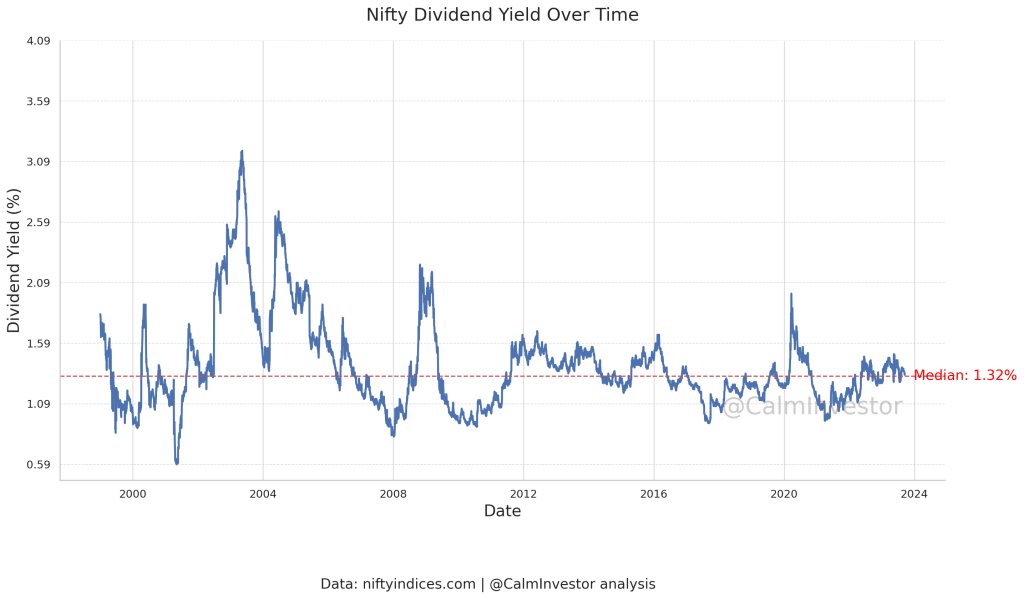

The reason for the difference might be that the Mint wringer didn’t consider dividends from Nifty stocks. The yield has historically ranged between 0.6% to as much as 3%, with a median value of 1.32%.

Overall, the specimen for long-term investing gets stronger when you moreover consider dividends stuff reinvested.

The post How likely is a 12% return over the long term? appeared first on The Calm Investor.